The Safety Net of Modern Life: Understanding Insurance and Its Essential Benefits

In the complex web of modern life, uncertainty is the only certainty. Whether it’s an unexpected illness, a car accident, property damage, or the loss of a loved one, unforeseen events can disrupt both peace of mind and financial stability. This is where insurance enters as a silent protector—an unsung hero that stands between chaos and recovery.

Despite its crucial role, many people still view insurance as a mere legal requirement or an added expense. However, when understood deeply, insurance emerges as one of the most powerful tools for financial planning and risk management. In this article, we’ll unravel the core principles of insurance, examine its various types, and explore its many benefits for individuals, businesses, and society as a whole.

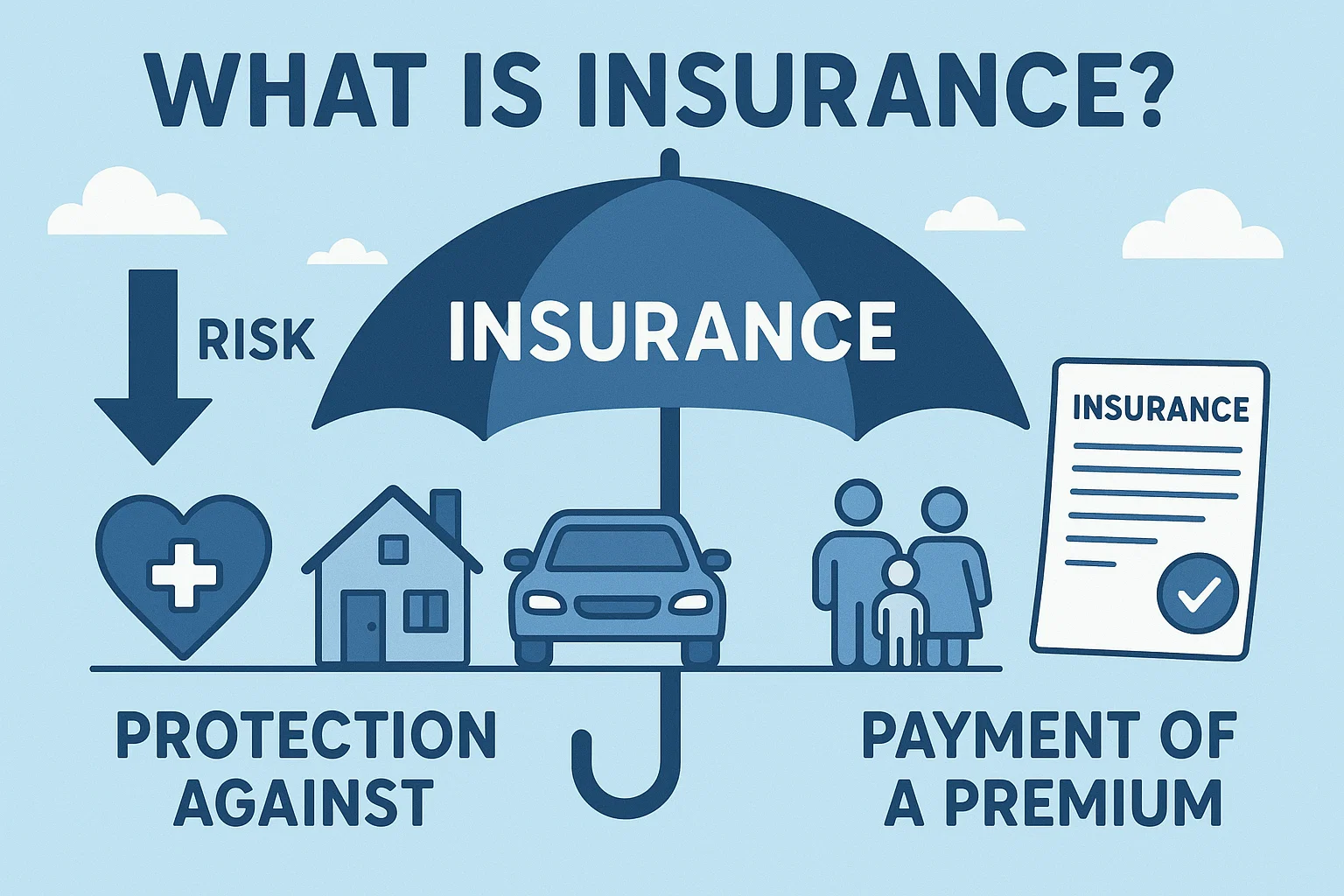

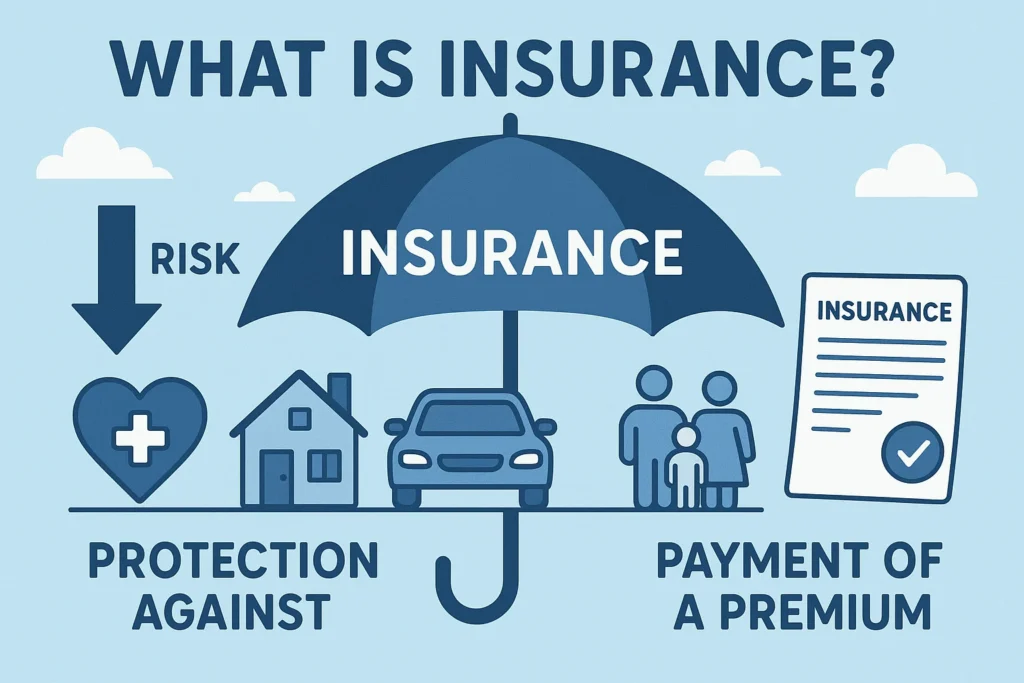

What is Insurance?

At its core, insurance is a contractual arrangement in which an individual or entity (the insured) receives financial protection or reimbursement against losses from an insurance company (the insurer). In exchange for paying a regular fee known as a premium, the insurer agrees to cover specified losses, damages, or liabilities that may arise in the future.

The principle underpinning insurance is risk pooling. A large number of policyholders contribute to a common fund (through premiums), and when a claim arises, money from that fund is used to compensate the person or entity that has suffered a loss. This process spreads financial risk across many individuals, making unexpected events more manageable for everyone.

Brief History of Insurance

Insurance has existed in various forms for thousands of years. Ancient Babylonians used a rudimentary form of insurance in their Code of Hammurabi (circa 1750 BCE), where merchants paid lenders extra fees to cancel loans if their shipments were lost or stolen. The concept evolved in Ancient China, where traders spread goods across multiple vessels to mitigate maritime losses.

Modern insurance as we know it began to take shape in 17th-century London. The Great Fire of London in 1666 led to the rise of property insurance, and soon after, Lloyd’s of London was established as a market for marine insurance.

Over the centuries, the industry diversified and matured. Today, insurance covers everything from life and health to cyberattacks and climate risks.

Main Types of Insurance

Insurance can be broadly categorized based on the needs it serves. Here are the most common types:

Life Insurance

This provides a lump-sum payment to beneficiaries upon the death of the insured. It is essential for providing financial support to dependents and ensuring long-term family stability.

Health Insurance

This covers medical expenses including doctor visits, hospital stays, surgeries, and prescription medications. With rising healthcare costs, health insurance is crucial for accessing timely and quality treatment.

Property and Home Insurance

Covers damages or losses to property due to fire, theft, natural disasters, and other risks. Homeowners and renters alike benefit from this coverage.

Auto Insurance

Mandatory in many countries, this covers vehicle damage and liability in case of accidents. It protects both the driver and others involved in the incident.

Travel Insurance

This helps travelers manage risks such as trip cancellations, medical emergencies abroad, lost luggage, and flight delays.

Business Insurance

Designed for enterprises, this includes liability, property, employee-related risks, and even cyber insurance. It helps businesses stay resilient in times of crisis.

Core Benefits of Insurance

Understanding insurance’s advantages helps illustrate why it should be considered a cornerstone of financial literacy. Let’s explore the many benefits:

Financial Security and Peace of Mind

The most obvious benefit of insurance is financial compensation in times of loss. Whether it’s a hospital bill, vehicle repair, or a family’s living expenses after a loved one’s death, insurance reduces the immediate financial burden. Knowing you are covered brings peace of mind, letting you live without fear of ruin.

Risk Management and Loss Mitigation

Insurance is a key part of risk management—a strategy to handle uncertainties and mitigate potential losses. By transferring the financial risk to insurers, individuals and businesses can focus on their goals without being overwhelmed by the fear of catastrophe.

Encourages Savings and Investment

Some forms of insurance, like whole life or endowment policies, also serve as long-term savings instruments. They build cash value over time, which can be borrowed against or withdrawn. This dual purpose encourages disciplined savings habits among policyholders.

protection for Families and Dependents

Life insurance, in particular, serves as a legacy tool, ensuring that dependents aren’t financially stranded after the breadwinner’s demise. It can pay off debts, cover education costs, and provide a cushion during the emotional and financial transition.

Facilitates Business Continuity

Businesses face multiple risks, from lawsuits and property damage to cyber threats and employee liabilities. Commercial insurance policies provide stability and ensure operations continue despite setbacks, making them essential for sustainable business growth.

Legal and Social Requirements

In many jurisdictions, insurance is mandatory. For example, vehicle owners must have auto liability insurance, and employers must carry workers’ compensation. These regulations protect not only the insured but also third parties affected by their actions.

Promotes Economic Stability

On a macro level, insurance is a pillar of economic resilience. By reducing the financial impact of disasters and disruptions, insurance helps individuals bounce back faster and reduces the burden on public welfare systems. It also fosters entrepreneurship by allowing businesses to take calculated risks.

Support in Times of Catastrophe

Natural disasters, pandemics, and global crises can cause widespread economic damage. Insurance plays a critical role in disaster recovery, channeling funds quickly to affected individuals and regions. This quick response can help stabilize communities and economies alike.

The Role of Technology in Modern Insurance

The insurance industry is undergoing rapid transformation, thanks to digital technology. The rise of InsurTech—a blend of insurance and technology—is making insurance more accessible, affordable, and user-friendly.

- AI and Machine Learning are used for underwriting, fraud detection, and personalized recommendations.

- Blockchain ensures secure, transparent policy and claims management.

- Mobile Apps allow users to manage policies, file claims, and track renewals in real time.

- Telematics in auto insurance helps set premiums based on actual driving behavior rather than assumptions.

These innovations are not just enhancing efficiency but also reshaping customer expectations and product offerings.

Common Misconceptions About Insurance

Despite its benefits, several myths still discourage people from getting insured:

- “I’m young and healthy; I don’t need insurance.”

Accidents and illnesses can happen at any age. Insurance is cheaper and more effective when bought early. - “Insurance companies don’t pay claims.”

While claim disputes exist, most reputable insurers have high settlement ratios. Reading policy terms thoroughly prevents misunderstandings. - “It’s too expensive.”

Basic insurance coverage is often affordable, especially compared to the potential cost of facing a crisis without it. - “I can self-insure.”

Unless you’re extremely wealthy, absorbing large unexpected costs on your own can derail financial plans.

Tips for Choosing the Right Insurance

To get the most out of insurance, consider the following:

Assess Your Needs – Choose insurance based on lifestyle, age, dependents, income, and future goals.

Compare Policies – Look at coverage, premiums, claim procedures, and provider reputation.

Read the Fine Print – Understand exclusions, deductibles, waiting periods, and renewal terms.

Review Periodically – Life changes, and so do your insurance needs. Reassess your policies regularly.

The Invisible Safety Net We All Need

Insurance is more than just a financial product—it’s a tool for empowerment, security, and hope. It enables individuals to dream, businesses to grow, and societies to flourish. Whether you’re protecting your health, home, or legacy, the right insurance policy provides a cushion that can turn a crisis into a manageable event rather than a catastrophe.

Understanding insurance today is not just smart—it’s essential. In a world of uncertainties, insurance is the one certainty that helps you navigate life with confidence.